Medical debt is a pervasive issue in the United States, impacting millions of individuals and families. The high cost of healthcare, coupled with complex insurance systems, often leaves people struggling to manage mounting medical bills. For many, bankruptcy may seem like a drastic measure, but it can be a lifeline to regain financial stability and a fresh start.

This guide explores the intricacies of reducing medical debt through bankruptcy filings, providing valuable insights and practical advice.

We will delve into the different types of medical debt, the impact it has on personal finances, and the eligibility criteria for bankruptcy discharge. We’ll also examine the bankruptcy process itself, outlining the steps involved and the documents required. Additionally, we’ll explore alternative debt management strategies and the long-term consequences of bankruptcy on credit scores and future financial prospects.

Understanding Medical Debt and Bankruptcy

Medical debt can be a significant burden, affecting your financial well-being and overall health. It can arise from various medical expenses, such as hospital stays, doctor visits, prescriptions, and medical procedures. Understanding the different types of medical debt and the impact it can have on your finances is crucial for making informed decisions about managing your debt.

This section will discuss the different types of medical debt, its impact on personal finances, and the role of bankruptcy in debt relief.

Types of Medical Debt

Medical debt can be categorized based on the source of the expense. Common types of medical debt include:

- Hospital Bills:These are the largest expenses associated with medical care and can include charges for room and board, surgeries, and other medical services.

- Doctor’s Bills:These expenses cover office visits, consultations, and other services provided by physicians and specialists.

- Prescription Drugs:The cost of prescription medications can be substantial, especially for chronic conditions or complex treatments.

- Ambulance Services:Emergency medical transportation can generate significant debt, particularly if the ambulance service is not covered by insurance.

- Medical Equipment:Expenses for medical devices, such as prosthetics, wheelchairs, and oxygen concentrators, can contribute to medical debt.

Impact of Medical Debt on Personal Finances

Medical debt can have a significant impact on your personal finances, leading to:

- Reduced Credit Score:Unpaid medical bills can negatively affect your credit score, making it difficult to obtain loans, credit cards, or even rent an apartment.

- Collection Agencies:If you fail to pay your medical bills, they can be sent to collection agencies, which can further damage your credit score and result in harassment and legal action.

- Wage Garnishment:In some cases, creditors can pursue wage garnishment, where a portion of your paycheck is automatically deducted to pay off your debt.

- Bankruptcy:Unmanageable medical debt can lead to financial distress and bankruptcy, a legal process that allows individuals to discharge their debts.

- Stress and Anxiety:The financial burden of medical debt can cause stress and anxiety, affecting your mental and physical health.

Chapter 7 Bankruptcy

Chapter 7 bankruptcy is a liquidation proceeding where a debtor’s assets are sold to pay off creditors. It is often referred to as a “fresh start” because it allows individuals to discharge most of their debts, including medical debt.

- Eligibility:To be eligible for Chapter 7 bankruptcy, individuals must meet certain income and asset requirements. The court will review your income and expenses to determine if you qualify for Chapter 7.

- Process:The process involves filing a petition with the bankruptcy court, listing all your assets and debts. A trustee is appointed to oversee the liquidation of your assets, and creditors are paid from the proceeds. If there are insufficient funds to pay all creditors, the remaining debts are discharged.

- Dischargeable Debts:Most types of debt, including medical debt, can be discharged in Chapter 7 bankruptcy. However, certain debts, such as student loans and taxes, are typically not dischargeable.

Chapter 13 Bankruptcy

Chapter 13 bankruptcy is a reorganization proceeding where individuals create a repayment plan to pay off their debts over a period of three to five years. It is often used for individuals with regular income who want to keep their assets and repay their debts over time.

- Eligibility:Individuals must have regular income and be able to afford a repayment plan. The court will review your income and expenses to determine if you qualify for Chapter 13.

- Process:The process involves filing a petition with the bankruptcy court, proposing a repayment plan that Artikels how you will pay off your debts over a specified period. The court must approve the plan, and you are required to make regular payments to a trustee, who distributes the funds to your creditors.

- Dischargeable Debts:Most types of debt, including medical debt, can be discharged under Chapter 13 bankruptcy, provided that you make all payments according to the approved plan.

Seeking Legal Advice and Support

Navigating the complex world of bankruptcy can be daunting, and seeking legal guidance from a qualified bankruptcy attorney is crucial. A bankruptcy lawyer provides expert knowledge and support, ensuring you understand your rights and options while navigating the legal process.

The Importance of Consulting a Bankruptcy Lawyer

Engaging a bankruptcy lawyer is essential for several reasons. They possess the legal expertise to understand the intricacies of bankruptcy law and can help you determine if bankruptcy is the right option for your situation. They can guide you through the process, ensuring you meet all legal requirements and deadlines.

Moreover, a bankruptcy lawyer can negotiate with creditors on your behalf, potentially reducing your debt burden and achieving a more favorable outcome.

The Role of a Lawyer in the Bankruptcy Process

A bankruptcy lawyer plays a multifaceted role throughout the process. They provide comprehensive legal advice, helping you understand the different types of bankruptcy, their implications, and the potential benefits and drawbacks. They assist in preparing and filing the necessary paperwork, ensuring accuracy and compliance with legal requirements.

They represent you in court proceedings, advocating for your interests and protecting your rights. Additionally, they handle communication with creditors, negotiating payment plans or debt discharge.

Finding a Reputable Bankruptcy Attorney

Finding a qualified and reputable bankruptcy lawyer is essential. Consider these tips:

- Seek referrals:Ask friends, family, or financial advisors for recommendations.

- Check online directories:Websites like the American Bar Association or the National Association of Consumer Bankruptcy Attorneys list certified bankruptcy lawyers.

- Consult the state bar:Your state bar association can provide information about licensed attorneys and any disciplinary actions.

- Schedule consultations:Meet with several lawyers to discuss your situation and get a feel for their expertise and communication style.

- Ask about fees:Discuss the attorney’s fee structure, payment options, and any additional costs involved.

Financial Considerations and Planning After Bankruptcy

Bankruptcy can be a significant financial setback, but it’s crucial to remember that it’s not the end. After filing for bankruptcy, you have the opportunity to rebuild your finances and create a more stable future. This section focuses on the essential steps you need to take to manage your finances and navigate the post-bankruptcy period effectively.

Creating a Budget and Financial Plan

A budget is a vital tool for managing your finances, especially after bankruptcy. It helps you track your income and expenses, identify areas where you can save money, and plan for future financial goals.

- Track Your Income and Expenses:Carefully record all your income sources and expenses for a few months to get an accurate picture of your financial situation. Use a budgeting app, spreadsheet, or notebook to keep track of your spending.

- Prioritize Essential Expenses:Identify essential expenses like housing, utilities, food, transportation, and healthcare. Allocate enough funds to cover these needs. You can also consider reducing non-essential expenses, such as entertainment, dining out, and subscriptions.

- Set Realistic Financial Goals:Determine your short-term and long-term financial goals, such as saving for emergencies, building credit, or paying off debt. Break down these goals into smaller, achievable steps.

- Create a Spending Plan:Allocate your income to different categories, ensuring you have enough money for essential expenses and saving. You can use the 50/30/20 rule as a starting point: 50% for needs, 30% for wants, and 20% for savings and debt repayment.

Rebuilding Credit After Bankruptcy

Rebuilding credit after bankruptcy can take time and effort. It’s essential to understand the process and take proactive steps to improve your credit score.

- Check Your Credit Report:Request a free copy of your credit report from all three credit bureaus (Equifax, Experian, and TransUnion) to identify any errors or inaccuracies.

- Start Small:Consider opening a secured credit card, which requires a security deposit, to establish a positive credit history.

- Make Payments on Time:Consistent and timely payments on all your accounts are crucial for improving your credit score. Set up automatic payments or reminders to ensure you never miss a deadline.

- Avoid Excessive Debt:Resist the temptation to accumulate more debt, especially high-interest credit card debt. Focus on building a strong financial foundation before taking on new loans.

Avoiding Future Debt

After bankruptcy, it’s crucial to learn from past mistakes and implement strategies to avoid future debt.

- Create a Spending Plan:A budget helps you track your spending and identify areas where you can cut back or make adjustments.

- Avoid Impulse Purchases:Before making a purchase, consider whether it’s a necessity or a want. If it’s a want, wait for a few days before making a decision.

- Shop Around for Better Rates:Compare interest rates and terms for loans, credit cards, and other financial products to ensure you get the best deals.

- Use Credit Cards Wisely:Pay off your credit card balance each month to avoid accruing interest.

Resources and Information for Financial Literacy

Financial literacy is essential for managing your money effectively and avoiding future debt.

- National Endowment for Financial Education (NEFE):NEFE offers a wide range of resources, including online courses, workshops, and articles on budgeting, saving, investing, and credit.

- Consumer Financial Protection Bureau (CFPB):The CFPB provides information on consumer rights and protections, including resources on debt management and credit reporting.

- Financial Counseling and Credit Counseling Services:Many organizations offer free or low-cost financial counseling and credit counseling services. These services can provide personalized guidance and support to help you manage your finances.

Related Financial Topics

Beyond medical debt and bankruptcy, understanding various financial concepts can contribute to a stronger financial foundation. Here are some key topics related to personal finance and debt management.

Finance: Comparing Investment Options

Different investment options cater to various risk tolerances and financial goals. This table compares popular investment options:| Investment Option | Risk Level | Potential Return | Liquidity ||—|—|—|—|| Savings Account | Low | Low | High || Money Market Account | Low | Low | High || Certificate of Deposit (CD) | Low | Moderate | Low || Bonds | Moderate | Moderate | Moderate || Stocks | High | High | Moderate || Real Estate | High | High | Low |

Auto Loans: The Application Process

Understanding the car loan application process can help you secure favorable terms. Here are the steps involved:* Pre-approval:Contact multiple lenders to get pre-approved for a loan.

Research and Choose a Vehicle

Determine your budget and choose a vehicle that fits your needs.

Apply for Financing

Submit a loan application to the chosen lender, including your financial information.

Credit Check and Approval

The lender will check your credit score and approve or decline your loan.

Negotiate Terms

Discuss interest rates, loan terms, and any additional fees.

Sign Loan Documents

Once you agree to the terms, sign the loan documents and receive the funds.

Bankruptcy Lawyers: Questions to Ask

Consulting with a bankruptcy lawyer is crucial to understand your options and navigate the process effectively. Here are questions to ask potential lawyers:* What is your experience handling bankruptcy cases?

- What is your fee structure?

- What is your success rate?

- What is your approach to bankruptcy proceedings?

- What are the potential risks and benefits of filing for bankruptcy?

Bankruptcy Medical: Prevalence of Medical Debt

Medical debt is a significant problem in the United States. According to a 2022 study by the Kaiser Family Foundation:* 43% of adultshave medical debt.

- 1 in 5 adultshave medical debt in collections.

- Medical debt accounts for 58% of all consumer debt in collections.

Bankruptcy Personal: Steps Involved

Filing for personal bankruptcy involves a specific process. This flowchart Artikels the steps:* Seek Legal Advice:Consult with a bankruptcy attorney to determine if bankruptcy is the right option.

Gather Financial Documents

Compile all necessary documents, including income, expenses, and debts.

File Bankruptcy Petition

Submit the petition to the court, outlining your financial situation and debts.

Creditors Meeting

Attend a meeting with creditors to discuss your debts and repayment plan.

Discharge of Debts

The court will discharge your eligible debts after the process is complete.

Bankruptcy Tips Advice: Avoiding Bankruptcy

Taking proactive steps can help you avoid bankruptcy in the future. Here are some tips:* Create a Budget:Track your income and expenses to identify areas where you can save money.

Reduce Debt

Develop a plan to pay down existing debts, such as consolidating or negotiating lower interest rates.

Build Emergency Savings

Set aside funds for unexpected expenses to avoid accumulating debt.

Seek Credit Counseling

Consult with a credit counselor to develop a debt management plan.

Monitor Credit Report

Regularly check your credit report for errors and take steps to improve your credit score.

Credit Counseling: Services Offered

Credit counseling agencies provide guidance and support for managing debt. Their services typically include:* Debt Management Plans:Develop a plan to repay debts through a single monthly payment.

Budgeting and Financial Education

Teach strategies for managing finances and avoiding debt.

Credit Counseling

Provide advice on improving credit scores and building healthy credit habits.

Debt Consolidation

Help consolidate multiple debts into a single loan with lower interest rates.

Negotiation with Creditors

Advocate on your behalf to negotiate lower interest rates or payment plans.

Credit Tips: Building Good Credit

Building good credit is essential for securing loans and credit cards with favorable terms. Here are some best practices:| Practice | Description ||—|—|| Pay Bills on Time | Consistent on-time payments are crucial for a good credit score. || Keep Credit Utilization Low | Aim for a credit utilization ratio below 30%.

|| Diversify Credit Mix | Have a mix of credit cards, loans, and other credit products. || Monitor Credit Report | Regularly check your credit report for errors and fraud. || Avoid Opening Too Many Accounts | Opening multiple accounts in a short period can negatively impact your credit score.

|

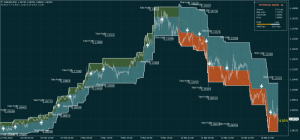

Currency Trading: Basics and Risks

Currency trading involves buying and selling currencies to profit from exchange rate fluctuations. Here are the basics:* Currency Pairs:Traders buy one currency while simultaneously selling another currency.

Exchange Rates

The value of one currency relative to another determines profit or loss.

Leverage

Trading platforms allow traders to borrow funds to amplify their potential profits or losses.Currency trading involves significant risks:* Market Volatility:Exchange rates can fluctuate rapidly, leading to substantial losses.

Leverage

Using leverage can amplify both profits and losses.

Trading Costs

Fees, commissions, and spreads can impact profitability.

Debt Consolidation: Comparing Options

Debt consolidation combines multiple debts into a single loan with a lower interest rate. Here are common options:* Balance Transfer Credit Cards:Transfer existing balances to a card with a lower interest rate for a limited period.

Personal Loans

Obtain a loan from a bank or credit union to pay off multiple debts.

Debt Consolidation Loans

Similar to personal loans but specifically designed for debt consolidation.

Debt Management: Role of a Plan

A debt management plan helps individuals manage their debt and reduce interest charges. Here’s how it works:* Credit Counseling:A credit counselor reviews your finances and creates a plan.

Negotiation with Creditors

The counselor negotiates with creditors to lower interest rates or payment amounts.

Single Monthly Payment

You make a single monthly payment to the credit counselor, who distributes it to creditors.

Debt Reduction

The plan typically aims to reduce debt over a set period.

Debt Relief: Comprehensive Overview

Debt relief programs offer various options for individuals struggling with overwhelming debt. These programs include:* Bankruptcy:Filing for bankruptcy can discharge certain debts, but it has significant legal and financial implications.

Debt Settlement

Negotiate with creditors to settle debts for less than the full amount owed.

Debt Consolidation

Combine multiple debts into a single loan with a lower interest rate.

Credit Counseling

Receive guidance and support for managing debt and improving credit scores.

Estate Plan Trusts: Setting Up a Living Trust

A living trust allows you to transfer assets to beneficiaries while maintaining control during your lifetime. Here’s a guide to setting up a living trust:* Consult with an Attorney:Seek legal advice to ensure the trust is properly structured and meets your needs.

Draft the Trust Document

Create a written document outlining the terms of the trust, including assets, beneficiaries, and trustee responsibilities.

Fund the Trust

Transfer assets to the trust, such as real estate, investments, and bank accounts.

Name a Trustee

Designate a person or entity to manage the trust assets and distribute them according to your instructions.

Review and Update

Periodically review and update the trust document as needed to reflect changes in your circumstances.

Home Equity Loans: Benefits and Drawbacks

Home equity loans use your home’s equity as collateral for a loan. Here are the benefits and drawbacks: Benefits:* Lower Interest Rates:Typically have lower interest rates than personal loans.

Tax Deductibility

Interest payments may be tax-deductible.

Large Loan Amounts

Can borrow substantial sums of money based on your home’s equity. Drawbacks:* Risk of Foreclosure:If you default on the loan, you could lose your home.

Increased Debt

Adding a loan to your existing debt burden can make it harder to manage finances.

Fees and Closing Costs

There are typically fees and closing costs associated with home equity loans.

Final Wrap-Up

Navigating the complexities of medical debt and bankruptcy can be daunting, but it’s essential to remember that you’re not alone. By understanding your options, seeking legal counsel, and making informed decisions, you can effectively manage your medical debt and work towards a brighter financial future.

Remember, knowledge is power, and taking control of your financial situation is the first step towards recovery.

Common Queries

What types of medical debt can be discharged in bankruptcy?

Most medical debt, including hospital bills, doctor’s visits, and prescription costs, can be discharged in bankruptcy. However, some debts, like student loans, may not be eligible for discharge.

How does bankruptcy affect my credit score?

Bankruptcy has a significant negative impact on your credit score, but it’s not permanent. Your credit score will gradually improve over time as you rebuild your credit history.

What are the alternatives to bankruptcy for medical debt?

Alternatives include debt consolidation, debt management plans, and credit counseling. These options may be suitable for individuals with manageable debt and a good payment history.

How long does the bankruptcy process take?

The duration of the bankruptcy process varies depending on the complexity of the case. Chapter 7 bankruptcy typically takes 4-6 months, while Chapter 13 bankruptcy can take 3-5 years.

What are the long-term consequences of bankruptcy?

Bankruptcy can impact your ability to obtain loans, rent an apartment, or even get a job. However, with careful planning and responsible financial management, you can rebuild your credit and minimize the long-term effects.